Printable Budget Planners: Mastering Your Finances with Ease

by urdigitalplanet in Blog on December 28, 2023Introduction

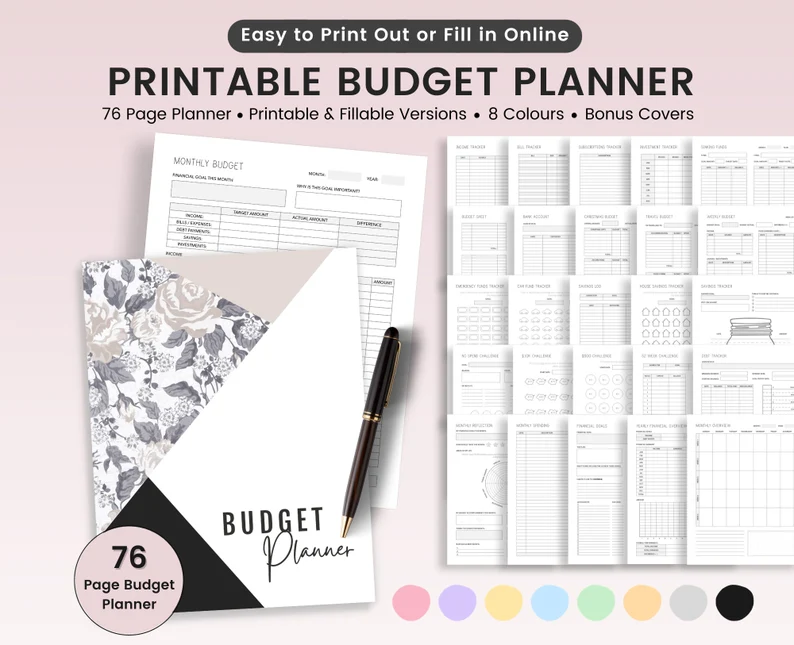

In today’s fast-paced world, managing personal finances can be a challenging task. Printable budget planners offer a practical and accessible solution to this problem. They are not just tools for tracking expenses, but also powerful instruments for financial empowerment. This blog post will delve into the benefits of using printable budget planners and guide you on how to effectively incorporate them into your financial routine.

The Benefits of Using a Printable Budget Planner

Visibility: Having a physical or digital copy of your budget helps you see where your money is going.

Customization: You can tailor a printable planner to your specific financial goals and lifestyle.

Accountability: Regularly updating your planner encourages a sense of responsibility towards your spending habits.

Choosing the Right Printable Budget Planner

Layout: Find a layout that is intuitive for you – whether it’s a simple spreadsheet or a detailed ledger.

Categories: Ensure it has categories that align with your typical spending areas.

Goals Tracking: Opt for planners that include sections for goal setting and monitoring.

Setting Up Your Budget Planner

- Determine Your Income: Write down your total monthly income.

- List Your Expenses: Categorize your expenses into fixed and variable.

- Set Financial Goals: Whether it’s saving for a vacation or paying off debt, include these in your planner.

- Allocate Funds: Assign a budget for each category and stick to it.

Tips for Effective Budget Planning

Be Realistic: Set achievable budget limits based on your income and expenses.

Regular Updates: Update your planner regularly to reflect any changes in your financial situation.

Review and Adjust: Periodically review your budget to see if it needs adjustments.

Incorporate Savings: Always include a category for savings, no matter how small.

Digital Tools to Complement Your Printable Planner

Consider using apps like Mint, YNAB (You Need A Budget), or PocketGuard for digital tracking alongside your printable planner.

Overcoming Common Budgeting Challenges

Unexpected Expenses: Always allocate a portion of your budget for emergencies or unexpected costs.

Staying Motivated: Keep your financial goals visible and remind yourself why you’re budgeting.

Conclusion

Printable budget planners are more than just tools; they are stepping stones towards financial literacy and independence. By carefully documenting and analyzing your spending, you can gain control over your finances and achieve your financial goals. Start planning today and watch as your financial health transforms.