Mastering Finances with Printable Budgeting Sheets and Templates

by urdigitalplanet in Blog on December 20, 2023Introduction

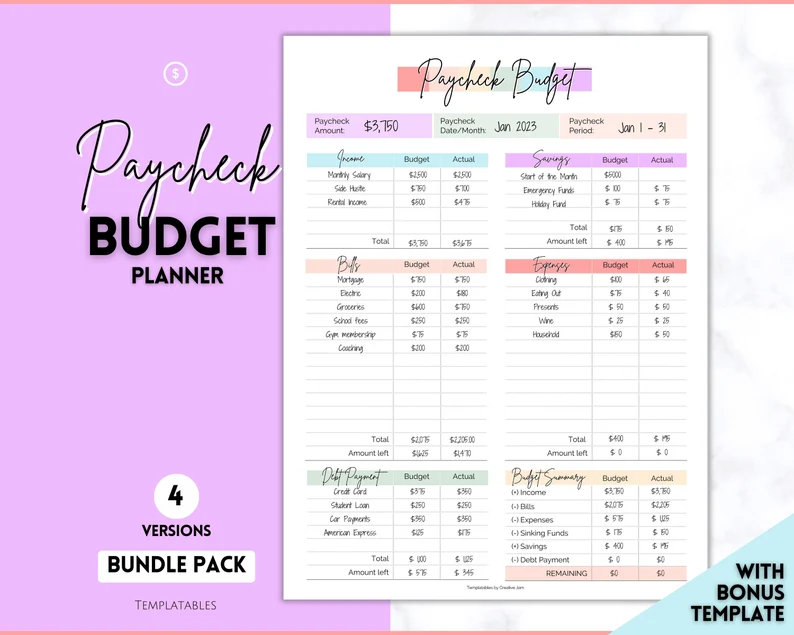

Effective budgeting is essential for financial stability and growth, both personally and professionally. In an age where digital solutions are often highlighted, the simplicity and tangibility of printable budgeting sheets and templates remain incredibly powerful. For those seeking to gain better control of their finances, these tools offer an accessible, customizable, and hands-on approach. This blog post delves into the benefits of using printable budgeting sheets and templates and how they can transform your approach to managing money.

The Importance of Budgeting

Budgeting is not just about tracking expenses; it’s about understanding your financial habits, setting realistic goals, and making informed decisions. It’s a critical step towards financial freedom and security, helping to avoid debt, save for future goals, and reduce financial stress.

Advantages of Printable Budgeting Sheets

- Tangible Tracking: Physical interaction with your budget can lead to a better understanding and commitment.

- Customization: Tailor your budget sheets to fit your specific financial situation and goals.

- Accessibility: Easy to use without the need for technology or apps.

- Visual Impact: Physically seeing where your money goes can be a powerful motivator for change.

Creating Effective Printable Budgeting Sheets

- Identify Your Needs: Determine what aspects of your finances you need to track – income, expenses, savings, debts, etc.

- Choose a Layout: Decide on a weekly, monthly, or annual layout depending on your preference.

- Include Essential Categories: Make sure to include categories like housing, food, transportation, entertainment, savings, and any other personal categories.

- Make It User-Friendly: Design your sheets to be easy to read and update.

Using Your Budgeting Sheets Effectively

- Regular Updates: Update your budget sheets regularly to keep track of your spending and adjust as needed.

- Review and Reflect: At the end of each period, review your spending. Identify areas for improvement and celebrate successes.

- Set Goals: Use your budget sheets to set and track financial goals, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

Tips for Staying on Track

- Be Realistic: Set achievable budgeting goals based on your actual income and expenses.

- Stay Committed: Make budgeting a regular part of your routine.

- Involve Family Members: If applicable, involve family members in the budgeting process to ensure everyone is on the same page.

Conclusion

Printable budgeting sheets and templates are more than just tools; they are stepping stones to financial awareness and discipline. By taking the time to create and maintain a personalized budget, you can gain a clearer picture of your financial health, make smarter financial decisions, and pave the way to a more secure financial future.